Families in India with a global perspective view unrestricted ability to transact, travel, and educate their kids as the ultimate sign of freedom. An Indian passport bestowed pride upon an Indian citizen, but there was an added friction involved from things like consular appointments to restrictions of freely being able to experience the world. This is why a second residency in a nation like Portugal is no longer a luxury consideration but a strategic tool to eliminate that friction. The Portugal Investment Visa provides certain legal avenues to establish longer-term optionality in Europe and affords high-net-worth individuals and their families an opportunity for mobility and safety.

Recently, the program has gained popularity with Indian applicants, establishing Portugal as a priority European destination for strategic investment. Existing data support that India is consistently one of the top three or four nationalities applying to the program; this shift suggests a strong strategic interest in establishing a home base with ties to the European Union and/or Schengen Area. Since the program’s inception, it has channeled billions of Euros into the Portuguese economy, a figure that continues to rise as investors explore new qualifying options. Understanding the revised rules and the strategic investment avenues is the first critical step for any Indian investor considering a Portugal investment visa for Indian nationals.

Understanding the New Landscape of the Portugal Investment Visa

The Portugal Golden Visa Program is a residence investment programme for non-EU nationals with a duration of five years. The fundamental benefits of the program are unchanged; a clear path to European citizenship in five years with only a 7-day residency requirement in the first year and 14 days in the subsequent two years.

Today, for prospective applicants, emphasis must be placed on capital transfers that can be for cultural preservation or investment funds, with the Fund Subscription option being the least complicated and most popular form of Portugal investment visa.

Current Qualifying Investment Options:

The updated legislation offers several distinct paths to securing the Portugal residence by investment:

Investment in Non-Real Estate Funds (The Most Popular Route): This option requires a minimum capital transfer of EUR 500,000 for the acquisition of non-real estate investment funds. These funds must be for a period of no less than 5 years with a minimum of 60% of the investment dedicated to a commercial entity(s) with a registered office in Portugal. The funds utilize professional management of assets and establish a way of returning the capital at maturity, making it naturally attractive to passive investors.

Cultural Heritage Preservation (The Lowest Entry Point): A minimum contribution of 200,000 Euros toward preserving cultural heritage in Portugal. A non-recoverable donation, which represents the lowest minimum capital commitment of any of the opportunities in the program.

A Detailed Look at the Portugal Investment Visa Cost

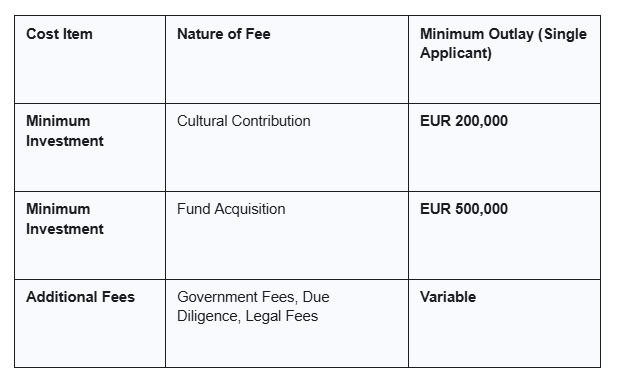

Beyond the minimum investment amount, Indian applicants must budget for a comprehensive breakdown of government fees, due diligence, and legal support. Properly calculating the total Portugal investment visa cost is essential for effective financial planning.

The breakdown highlighted above demonstrates that the overall cost associated with the Portugal golden visa cost far exceeds the minimum capital investment. In addition to the capital investment requirements, the applicant pays government and due diligence fees, and their legal fees to file the application. If a Fund Subscription investment option is selected, investors must factor in the annual management fees and any subscription fees associated with the fund. This is why obtaining a proper, tailored initial estimate on these additional costs from the best professional Portuguese golden visa consultants is critical early on in the process.

The Tax Advantage: NHR Status and Your Investment Visa

The Portugal investment visa offers one of the most attractive strategic advantages for Indian applicants by making them potentially eligible for Portugal’s preferential tax regime. The Non-Habitual Resident (NHR) status, notwithstanding the changes, is still a powerful tax advantage for global investors.

Tax advantages can be significant, with a flat 20% tax rate on qualifying Portuguese-sourced income, and exemptions from taxation on foreign-sourced income like dividends and capital gains for a ten-year period for eligible income. As India and Portugal have a Double Taxation Avoidance Agreement (DTAA), the effective immigration strategy using the visa combined with a tax strategy could be effective for international financial optimization.

It is important to realize that the Portugal Investment Visa is a residency permission – which is the first step to establish tax residency (which you are only required to spend 183 days in Portugal or establish habitual habitation). Hy-Net-Worth investors looking for global tax efficiency there is no better time than to understand your real financial commitment, this will include the Portugal golden visa total costs so you have the ability to weigh tax savings against your investment to find the optimum outcome.

Step-by-Step Application for Indian Applicants

The steps to receive a Portugal investment visa for Indian nationals is a methodical legal process that necessitates precision, particularly in respect to document verification and compliance with providing documentation related to source of funds.

Initial consultation and due diligence: The process commences with consulting with Portugal golden visa consultants to undertake pre-loan due diligence on the applicant´s profile.

Get NIF and bank account set-up: You will get a Portuguese Tax Identification Number (NIF) and you will get a bank account established in Portugal. In some scenarios, it is possible to do this remotely; you can authorize someone acting on your behalf to complete the process.

Investment and LRS compliance: The investment process is carried out. It is critical for Indian nationals to appropriately plan for the Liberalised Remittance Scheme (LRS). The investment funds must move from India and be within the per-person per year limits of the Reserve Bank of India (RBI).

Document Preparation and Submission: All personal documents that are required for the application and process, including Police Clearance Certificates, must be apostilled (India is a member of the Hague Convention) and translated by a licensed Portuguese translator. The full application will then be pre-submitted online to AIMA (Agência para a Integração, Migrações e Asilo).

Biometrics Appointment: The applicant and all dependents must travel to Portugal for a single in-person mandatory visit to provide biometric data and access to original documents.

Permit Issuance: Upon final approval, the two-year temporary Portugal residence by investment card is issued.

Learn more: How to Apply for the Portugal Golden Visa

The Path to Permanent Residency and Citizenship

The primary goal of the Portugal Investment Visa is the clear and short pathway to full EU citizenship. After five years of holding the temporary residence permit, the applicant becomes eligible to apply for either Portugal PR by investment (Permanent Residency) or full Portuguese citizenship. For citizenship, an applicant must maintain a clean criminal record and demonstrate a basic A2 level of proficiency in the Portuguese language. The low stay requirement makes this path flexible for those who do not wish to immediately or permanently relocate. You can also include your spouse, financially dependent children, and financially dependent parents in the residency application.

How FRR Immigration Blogs Can Help

The shift in investment requirements and complexities of compliance—be it internationally to ID and the compliance with Portuguese law or domestically with Indian financial regulation—will require engagement with skilled professionals for a successful application. FRR Immigration takes a complex process and makes it easier for Indian candidates who want a Portugal investment visa. We provide a variety of services to clarify and operate within compliance during the residency process in Portugal:

Customized Investment Due Diligence: We help clients to eligible, regulated investment funds above the government mandated EUR 500,000 minimum investment or cultural projects starting from EUR 200,000; we ensure the investment meets your broader financial goals and the strict government rules.

LRS & Source of Funds Compliance: We offer detailed guidance navigating the Indian liberalised remittance scheme (LRS) limits while structuring fund transfers to legally and fully complete the required investment. Our legal team specializes in preparing the “Source of Funds” documentation which is a prominent area of scrutiny when it comes to Indian applications.

NIF, Bank Account, and Power of Attorney: We handle the remote administrative arrangements (i.e., NIF (Tax Number) and the Portuguese bank account processes) efficiently and simply using a trusted local representative such that you will avoid an initial trip to Portugal.

Full Document Preparation Process: As experienced Portugal golden visa consultants, we handle the entire document preparation process through certified translation and apostille services, manage, and supervise online submission to the relevant government authority, plus we provide very detailed instruction and preparation for the mandatory biometrics appointment process.

Renewal and Citizenship: Our commitment to you extends throughout the five-year period covering the two-year renewal applications and all the necessary document preparation process for the final application for Portugal or by investment or citizenship.

Are you ready to secure your future in Europe with the Portugal Investment Visa?

Contact the experts at FRR Immigration today for a private, comprehensive consultation and take the first step toward getting residency in Portugal through a compliant and strategic investment.