For high-net-worth individuals and their families in India, the prospect of securing a U.S. Green Card through investment is highly appealing. The EB-5 Immigrant Investor Program offers a structured route to permanent residency, but a thorough understanding of the financial commitment is essential. The question, “How much does the EB-5 Visa Cost really?” is much more nuanced than just the minimum required investment.

This comprehensive EB-5 Visa Cost Guide breaks down every financial component involved, from the core capital requirement to the various administrative and governmental fees, providing a clear picture of the total outlay for EB-5 visa for Indian investors.

The Core Capital Investment: $800,000 or $1,050,000

The required capital investment in a U.S. commercial enterprise is the largest piece of the overall EB-5 Visa Cost. USCIS will set the amount required based on the location and type of project.

1. Investment in Targeted Employment Area

The minimum amount of investment where the project is in a Targeted Employment Area (TEA) is $800,000. TEA however is defined as a rural area or an area which has high unemployment (150% of national average). Investments into TEA projects through a USCIS-approved Regional Center is the preferred route for most EB-5 investors from India and other countries because of the reasonable threshold.

2. Non-TEA Investment

For projects located outside of a TEA, or for a direct investment that is not in a TEA, the minimum required investment increases to $1,050,000.

It’s critical for any prospective investor seeking an EB-5 visa for Indian applicants to understand that this capital must be “at risk,” meaning the investment is subject to the inherent risks of any business enterprise. The capital is not a loan with a guaranteed return or fixed repayment schedule, though many Regional Center projects are structured as debt instruments offering a potential return upon maturity.

Project Administration Fees and Associated Expenses

Aside from the initial investment, there will be substantial administrative fees that will affect the overall EB-5 Visa Cost.

Regional Center Administrative Fee

If you select the Regional Center path, which is the most common path for an EB5 Investor Visa, you will usually face a hefty administrative fee. This fee is paid to the Regional Center or the project developer for project management, the structuring of the investment to be EB-5 compliant, economic analysis for job creation, and reports back to the investors.

These fees are not refundable and are charged up front. They can vary considerably but typically can be anywhere from $50,000 to $80,000. This administrative fee is part of the upfront capital outlay for the EB-5 Immigrant Investor Program.

Legal and Consulting Fees

The EB-5 process is complex and requires meticulous legal oversight, especially concerning the rigorous “Source of Funds” documentation required by the USCIS.

Immigration Attorney Fees: A specialized immigration attorney is necessary to prepare and file the investor’s I-526E/I-526 petition, I-485 (Adjustment of Status) or DS-260 (Immigrant Visa Application), and the final I-829 petition to remove conditions. These fees generally range from $25,000 to $35,000 for the full spectrum of services.

Source of Funds Report: For the EB-5 Visa cost for Indian applicants, the documentation proving the lawful source of the investment funds (which can come from salaries, business profits, sale of property, gifts, or loans) is particularly detailed, often requiring assistance from local and U.S. financial experts, adding to the overall legal and professional fees.

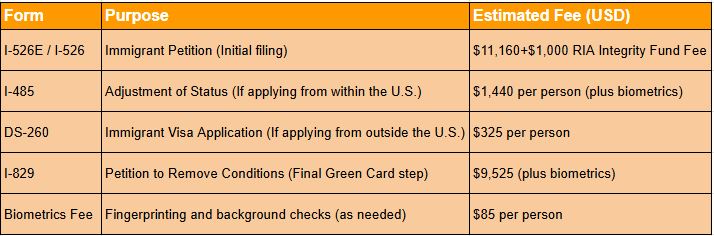

Government Filing Fees: The USCIS Component

The USCIS charges several non-refundable fees throughout the EB-5 application process. These fees are subject to change, and investors must be prepared for potential increases.

The total government fees alone for a family of four can amount to approximately $25,000 to $35,000 over the entire lifecycle of the application. This is a non-negotiable part of the complete EB-5 Visa Cost.

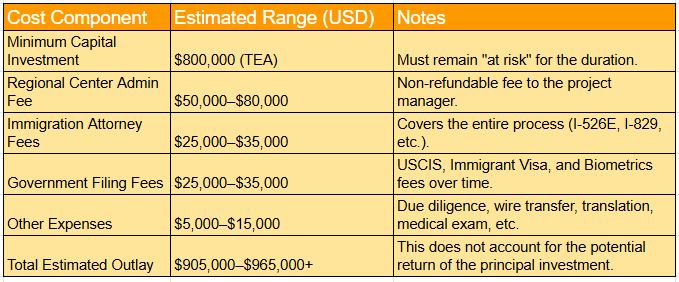

The Complete EB-5 Visa Cost for Indian Investors: A Summary

To provide a practical outlook for a prospective EB-5 visa for Indian investors, here is a hypothetical, comprehensive breakdown of the total financial commitment for a family of four using the Regional Center TEA option:

The actual cost of the EB-5 Visa is not merely the minimum investment, but rather, the total of all these financial components, which in this common circumstance, most often is at or above one million U.S. dollars. This is the more broad perspective that any serious investor pursuing the US EB-5 Visa Program needs to take. This financial clarity is vital for all foreign nationals seeking the EB-5 Visa for Immigrants category.

How FRR Immigration Can Simplify Your EB-5 Visa Cost Planning

The EB-5 Investor Visa process is more than a financial transaction; it is a complex immigration procedure. For clients in India, navigating the specific requirements of the US Immigrant Investor Program requires precise planning to ensure capital compliance and due diligence. FRR Immigration specializes in clarifying the full financial picture so there are no surprises on your EB-5 Visa Cost.

Here is how FRR Immigration provides essential support for your EB-5 Visa for Immigrants application:

Transparent and Upfront Cost: You will receive detailed information about all of the expected costs (minimum investment amount, administrative fees, legal fees, and government filing fees), so you will know the total cost of the US EB-5 Visa program in advance to alleviate some of the cost planning.

Thorough Review of the Project: Our team performs thorough due diligence on potential Regional Center projects, considering not just if the investment makes sense, but does it meet the job requirement— very important to getting conditional and permanent Green Card approval.

Corporate Fund Source Experience: We recognize how complicated it may be to document the legal source of funds for the applicant, especially in India. We work with expert legal assistance and create a comprehensive and audit-proof “Source of Funds” report, which is essential for the I-526E/I-526 and is mostly driven by the restrictions on the movement of currency from India.

Immigration Timeline Management: The EB-5 process is broken into steps, and we will walk with you for each step of the process from the I-526E submission, to the submission of form I-829 – we always make sure you are following the timeline required, and the document prerequisites, as delays or denials could contribute to the overall EB-5 Visa Cost.

Support After Approval: Our job isn’t done with the conditional Green Card in hand. We will continue to provide support and advice for the I-829 petition for permanent randomization conditions – whatever we can do to help you meet the job creation and at-risk requirements for a permanent Green Card in the U.S.

Selecting the right partner is the only route to successfully manage the whole range of the EB-5 immigration and investment undertaking. FRR Immigration is fully dedicated to providing Indian investors the support and clear understanding to achieve permanent residency in the U.S.

Are you ready to move forward with a clear financial roadmap associated with the EB-5 program?

EB-5 Immigrant Investor Program: Quick FAQ

1. Does the $$$800,000 investment cover the whole family’s Green Card cost?

No. The $800,000 (or $1,050,000) is the minimum capital investment per investor. This amount is the same regardless of the number of family members (spouse and children under 21) included in the primary investor’s petition. You will pay separate USCIS filing fees for each dependent.

2. Is the EB-5 investment capital ever returned to the investor?

Potentially, yes. The investment must remain “at risk” throughout the conditional residency period (typically 2+ years). The return of your principal capital is governed by the specific project’s term (often 5-7 years) and its financial success, as there is no guarantee of return.

3. What is the biggest non-investment part of the EB-5 Visa Cost?

The largest non-investment cost is usually the Regional Center Administrative Fee, which generally ranges from $50,000 to $80,000. This non-refundable fee covers the project’s structuring, compliance, and ongoing management, which are crucial for the integrity of your EB5 Investor Visa application.

4. Can I file my EB-5 application from within the U.S. if I am on an H-1B or F-1 visa?

Yes. If a visa is immediately available, investors already in the U.S. can file Form I-485 (Adjustment of Status) concurrently with their I-526E petition. This allows you to obtain work and travel authorization (EAD/Advance Parole) sooner while your Green Card application is processed.

5. Are there reserved EB-5 visas for Indian investors to avoid backlogs?

Yes. The EB-5 Reform and Integrity Act of 2022 created reserved visa categories (Rural, High Unemployment Area, and Infrastructure Projects). Investments in these reserved categories allow applicants from India to bypass the traditional country-specific backlogs that affect the unreserved EB-5 category.

Reach out to FRR Immigration today for individualized consultation regarding your cost and EB-5 Visa process.