For wealthy individuals and active families, especially those confronted with visa backlogs from India, establishing a stronghold in the US is a coveted goal. While the idea of straight-line US citizenship by investment USA is a common one (citizenship is always through the naturalisation process), the EB-5 Immigrant Investor Program provides the most judgment-free, validated, and expedited approach to obtaining a US Green Card, the necessary first step to reach that ultimate goal of citizenship.

This EB-5 Guide 2026 is essential because the EB-5 program is not static. California’s famous EB-5 program mellowed following the EB-5 Reform and Integrity Act (RIA) of 2022. However, the largest unknown is still approaching roughly 10 months from now, key deadlines to apply to the program. Beyond deadlines, the structure of the program has also changed, thus the ability to take advantage of reserved visa categories has given rise to unprecedented opportunities. You must become familiar with the reformed framework of US investment immigration to best position yourself in the future.

Understanding the EB-5 Pathway: Investor to Citizen

The EB-5 visa (Employment-Based Fifth Preference) grants the investor, their spouse, and their unmarried children under 21 a conditional permanent resident status in the US. The ultimate goal of US citizenship by investment can be achieved five years after receiving conditional permanent resident status via the naturalisation process.

Core Pillars of the EB-5 Visa

To become a participant of this premier US investment immigration programs, an applicant must satisfy three exacting standards, which emerged from the initial petition:

Capital Investment Commitment: The investor must engage in the minimum required investment for the EB-5 visa into a qualifying US Commercial New Enterprise (NCE).

Job Creation: The investment must adequately create or preserve at least 10 full-time jobs for eligible US workers, within two years of the investor’s admission as a Conditional Permanent Resident.

Source of Funds (SoF) Compliance: The investor must provide evidence to establish that the investment or capital was legally acquired and sourced.

The Minimum Investment for EB-5 Visa for 2026: A Direct Target

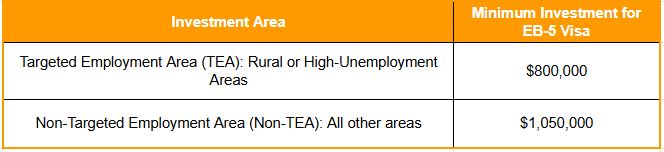

The EB-5 Reform and Integrity Act (RIA) of 2022 unified the minimum investment amounts and created standards for investors, for the purpose of planning for 2026. This will be temporary, as an inflation adjustment will be required.

Coming Inflation Adjustment: An important matter for applicants in 2026 is the required inflationary adjustment. The RIA provides that the investment minimums will shift every five years, and the next change will occur on January 1, 2027. While the precise new amounts will be contingent on the Consumer Price Index, both the $800,000 and $1,050,000 limits for the minimum investment for EB-5 visa are expected to increase in January 2027. The way to guarantee the lower minimum investment amounts, prior to inflation adjustment, is to file before the end of 2026.

Investment Programs: Regional Center v/s Direct

Individuals seeking citizenship by investment USA will generally use one of two different investment programs:

1. Regional Center (The Route Investors Prefer)

Mechanism: The investor’s money is pooled with other EB-5 money through a USCIS-designated Regional Center into a large scale, job-creating projects.

Job Creation Benefit: The major benefit of this mechanism is the ability to use indirect and induced jobs (jobs created outside of the commercial enterprise as a result of the project’s economic impact) to meet the 10 jobs requirement.

Management Requirement: The investor is not required to participate in a day-to-day management capacity, which makes this the better, passive investment option for those investors who are primarily interested in US investment immigration.

Lower Investment Threshold: The majority of Regional Center projects are designed in a manner that allows them to qualify as Targeted Employment Areas (TEAs), which permits investors to use the lower $800,000 minimum investment to create permanent residence under the EB-5 visa.

2. Direct Investment Program

Mechanism: The investor creates or invests into a New Commercial Enterprise and is involved in direct management.

Job Creation: The investor has to demonstrate the creation of 10 direct full-time jobs, that are employees on the payroll of the NCE.

Management Involvement: This route involves the investor actively participating in management or policy, which means the investor would have to be responsible for a great portion of the operation of the business.

The Discovery: Reserved Visas for Applicants from India.

For many professionals and families in India, who are often years, if not decades away from obtaining their respective EB-2/EB-3 employment-based categories, the EB-5 program is a significantly more appealing option to achieve US citizenship by investment for Indians. The Economic Act created reserved visa categories to provide a benefit to investors investing in high-impact areas, while providing a faster lane to visa processing for applicants from countries that typically face long wait times due to high volumes of applicants.

Set-aside categories include the following:

1. Rural Areas – 20% of total annual EB-5 visas

2. High-Unemployment Areas – 10% of total annual EB-5 visas

3. Infrastructure Projects – 2% of total annual EB-5 visas

Due to the Visa Bulletin for the end of 2025 and into 2026, all of the set-aside categories are Current for all countries, including India. This means that there are visas available immediately for these qualifying projects, meaning Indian EB-5 investors will avoid the large backlogs in many other US immigration programs, so the path to a conditional Green Card is much faster.

Additionally, applicants lawfully residing in the US (i.e. H-1B or F-1 visa holders) whose priority date is current (which is the case for all reserved categories) can file their I-526E petition at the same time they file to adjust status (I-485) and are then eligible to gain work authorisation (EAD) and advance parole (AP) travel permits while waiting for their Green Card approval.

The Multi-Step US Citizenship Process through Investment

The EB-5 process is provided to US Citizenship in several legal and financial steps, with the first step being:

Stage 1: The Initial I-526E Petition

Action: The investor files form I-526E (Immigrant Petition by Regional Center Investor).

Focus: The USCIS carefully analyzes the investment, the job creation plan, and the legal source of the capital; this step serves as confirmation of the legitimacy of your US citizenship by investment. The filing cost for this petition which was recently reinstated to its pre-April 2024 figure after a recent court decision is now $3,675.

Stage 2: Conditional Permanent Residence

Action: After the I-526E is approved, the family files for the conditional Green Card through Adjustment of Status (Form I-485) or Consular Processing (Form DS-260).

Focus: The family will be granted a Conditional Permanent Resident status valid for two years and enjoy the rights of the Green Card holder.

Stage 3: Removal of Conditions (I-829)

Task: Within the 90 days prior to the expiration of the conditional Green Card, the investor will need to file Form I-829.

Focus: The investor will be required to demonstrate that the full investment was “at risk” and that the 10 full-time jobs required were created and maintained by the investment project. The filing fee for this petition is currently $3,750.

Stage 4: Unconditional Permanent Residency

Status: An approved I-829 application means an unconditional 10-year Green Card will be issued to secure the family as part of the United States’ investment immigration program.

Stage 5: Naturalisation to US Citizenship

Action: After maintaining lawful permanent resident status for five continuous years, the investor becomes eligible to apply for full US citizenship (Form N-400).

Requirements: This requires passing a civics and English test, demonstrating good moral character, and taking the Oath of Allegiance.

How FRR Immigration Can Assist You with Your EB-5 Success.

The EB-5 program can be complicated, particularly in regards to Source of Funds (“SoF”) requirements and determining and selecting a safe, compliant and appropriate project to invest with. You want expertise with legal and financial expertise to facilitate, ensure, and support EB-5 to a successful conclusion. FRR Immigration can meet your needs to facilitate, ensure and support compliance of complex requirements.

Expertise to Indian Investors With Source of Funds (SoF): Not surprisingly, lawful tracing of capital is the single most basis for denying a petition of all petitions received. We have considerable expertise in creating lawful SoF documentation and also provide strategic direction and advice on lawful limits to an annual remittance and RBI guidelines of India’s Liberalised Remittance Scheme (LRS) for lawful and…

Carefully Evaluated Project Putting Projects at a Lower Risk: Access to thoroughly vetted EB-5 Regional Center Projects that focus on using the faster Rural and High-Unemployment set-aside visa categories – as long as the project is economically sustainable and structurally sound to contribute to the job creation requirements.

Strategic Concurrent Filing: For any of our clients that are in the US, we can advise on concurrent filing (I-526E and I-485) eligibility and implementation, in enriching the reserved visa categories to realize EAD and AP benefits significantly quicker than other US immigration programs.

Comprehensive Petition Management: Whether the initial I-526E submission or the culminating, vital I-829 filing for removal of conditions, we provide full petition management so that you have the utmost comfort in compliance with the regulations the entire way to US citizenship by investment.

Where do you go from here for U.S. residency and citizenship?

The opportunity to obtain U.S. permanent residency and US citizenship by investment is attractive, especially with the time savings now being afforded to those who apply to reserved EB-5 visa categories. With the expected 2027 inflation-based increase in EB-5 investment, the time to structure your EB-5 visa application with a minimum investment amount is now, prior to the increase taking effect.

Call FRR Immigration today for a confidential consultation so that we can complete a compliant and efficient immigration strategy for U.S. investment in 2026.

Frequently Asked Questions (FAQ)

Q1: Does the EB-5 program lead directly to US citizenship?

A: No. The EB-5 program is the fastest route to US permanent residency (Green Card). You become eligible to apply for US citizenship through investment via the naturalization process after holding permanent resident status for five years.

Q2: What is the current minimum investment required for the EB-5 visa?

A: The minimum investment for EB-5 visa projects is $800,000 in Targeted Employment Areas (TEAs) and $1,050,000 for non-TEA projects; these amounts are subject to a statutory inflation increase in January 2027.

Q3: Why is the EB-5 program attractive to Indian nationals?

A: For US citizenship by investment for Indian applicants, the EB-5 program offers a significant advantage: the reserved visa categories (Rural, High-Unemployment, Infrastructure) are currently “Current,” allowing investors to potentially bypass the decades-long backlogs in other employment-based US immigration programs.

Q4: What is the biggest challenge for Indian investors funding the EB-5?

A: The biggest challenge involves meticulous documentation to prove the Source of Funds and ensuring compliance with India’s Liberalised Remittance Scheme (LRS) limits (currently $250,000 per financial year per resident) when transferring the funds to the US. This requires careful planning and expert coordination.

Q5: Will the minimum investment amount increase soon?

A: Yes. The EB-5 Reform and Integrity Act mandates that the minimum investment for EB-5 visa amounts will be adjusted for inflation on January 1, 2027. Investors should aim to file their I-526E petition before this date to lock in the current thresholds.